do you have to pay taxes on inheritance in michigan

The annual exemption limit for 2022 is 16000 This means that there is no tax on gifts that do not exceed this amount. Michigan has a flat tax rate of 425.

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

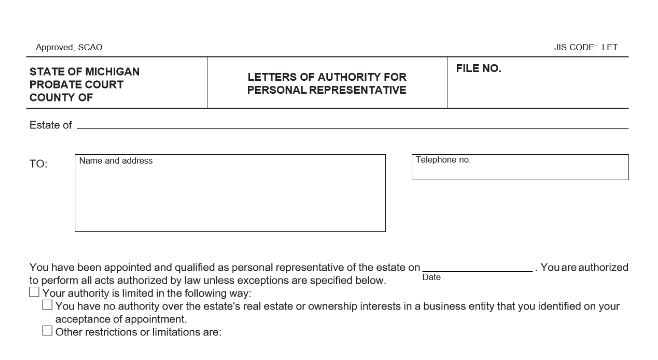

When a person dies in Michigan all of the money and property they own and the debts they owe at death are part of their estate.

. Inheritance tax rates differ by the state. So you would not need to pay anything for those. You have to report the sale if you did not own and live in the home for 2 of the 5 years immediately preceding the sale.

Michigans income tax rate is a flat 425 and local income taxes range from 0 to 24. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have. Michigan estate law is a compilation of the.

As of 2021 the six states that charge an inheritance tax are. If you receive property in an inheritance you wont owe any federal tax. Michigan no longer has an estate or inheritance tax.

Michigan Department of Treasury. Income Tax Range. With regard to appreciated assets if they qualify for a step-up in basis then.

These states have an inheritance tax. The first rule is simple. This gift-tax limit does not refer to the total amount you.

Here are the states where you wont have to pay separate estate or inheritance taxes. Michigan does not have an inheritance tax. The Michigan inheritance tax was eliminated in 1993.

The State of Michigan does not. A copy of all inheritance tax orders on file with the Probate Court. You might inherit 100000 but you would pay an inheritance tax on just 50000 if the state only imposes the tax on inheritances.

For instance the inheritance tax rate is as much as 18 in Nebraska so a beneficiary might owe the government 18000 if they. Each state has its own tax rates and criteria. Thats because federal law doesnt charge any.

Where do I mail the information related to Michigan Inheritance Tax. Inheritance tax is levied by state law on an heirs right to receive property from an estate. Its applied to an estate if the deceased passed on or before Sept.

Michigan does not have an inheritance tax with one notable exception. Who has to pay. An inheritance tax is a tax on the property you receive from the decedent.

Cities can levy income taxes as well on both residents and non-residents who are taxed 12 the rate of residents. If you have a new job you can figure out what your take home pay will be using our. There is no federal inheritance tax.

Only a handful of states still impose inheritance taxes.

Does Michigan Still Have Death Taxes Kershaw Vititoe Jedinak Plc

Where Not To Die In 2022 The Greediest Death Tax States

State Estate And Inheritance Taxes Itep

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

States With No Estate Or Inheritance Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Michigan Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Taxes In Michigan Michigan Estate Planning Lawyers

Michigan Inheritance Tax Explained Rochester Law Center

How To Remove A Deceased Owner From A Title Deed To Real Estate

Taxes On 401 K And Ira Distributions In Michigan

Michigan Probate Attorney Atlas Law

Inheritance Tax Who Pays Which States In 2022 Nerdwallet

Divorce Laws In Michigan 2022 Guide Survive Divorce

Michigan Inheritance Tax Explained Rochester Law Center

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

:focal(959x654:961x656)/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)